What is a Testamentary Trust?

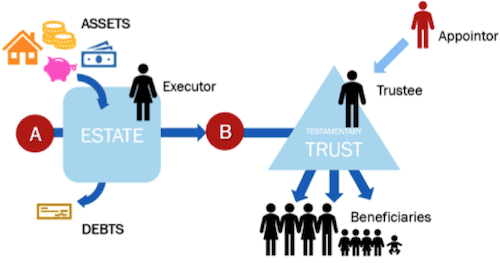

A testamentary trust is incorporated in a Will and does not come into effect until after the death of the will maker, also known as the Testator. Testamentary trusts can operate for a period of up to 80 years from the date of death of the Will maker.

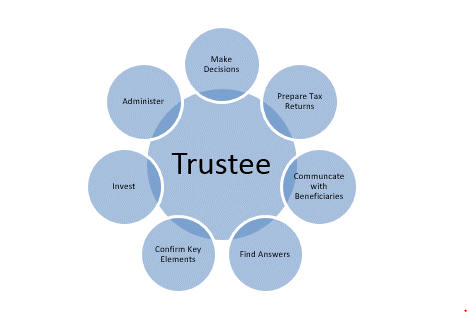

Under a Testamentary Trust structure, assets held by the testator at the time of their death do not pass directly into the hands of their family members or beneficiaries, but instead pass to one or more ‘discretionary trusts’ controlled by the people the testator names in their Will (known as the Trustees). The Trustee and beneficiary can be the same person(s), providing complete flexibility while managing the underlying assets. The trustee acts as the legal owner of trust assets and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust.

What is the difference between an Individual Trustee and a Corporate Trustee?

An individual trustee is a person who manages a trust. Title to the trust assets will sit with the person as trustee for the trust. Though the person legally owns the assets, they must hold the assets for the benefit of the beneficiaries. Where a trust has multiple trustees, each trustee must play an active role in managing the trust and comply with their duties as trustee.

A corporate trustee is a company that acts as trustee of a trust. The company is a registered company. However, it is often incorporated with the sole purpose of acting as trustee, meaning that the company will not conduct business. Like other companies, the corporate trustee has shareholders and directors. Ultimately, it is the directors of the corporate trustee who control the trustee (the company) and consequently control the distributions of the trust.

Who makes the decisions around a Testamentary Trust?

The trustee is given powers by the terms of the Testamentary Trusts to invest and distribute assets and income to persons who are beneficiaries, therefore has control of investment and distribution decisions relating to the Testamentary Trusts.

Once the Testamentary Trusts are established, the person nominated as the Appointor has ultimate control over the Testamentary Trusts, as they have power to remove and replace the trustee(s) and appoint additional trustees.

Need Guidance on Family Law Matters?

Navigating family law can be complex and emotionally challenging. Whether you’re dealing with custody issues, divorce proceedings, or any other family law matters, you don’t have to face it alone. Contact Matthies Lawyers today for expert legal advice and compassionate support. Let us help you find the best path forward.

What are the costs involved in managing a Testamentary Trust?

When the Testamentary Trust comes into existence, there will be costs to maintain the structure, including the cost of preparing and filing a tax return for the trust. The costs will vary depending on the type of assets and investment activities carried out by the Testamentary Trust.

Who can receive benefits from a Testamentary Trust?

The children or the person who is to be the main beneficiary of the Testamentary Trust is usually nominated as the “Primary Beneficiary”. The spouse and relatives of the “Primary Beneficiary” can receive benefit, but only if the trustee decides that they are to be eligible to receive a benefit. Just because they are members of the class of beneficiaries does not mean they have any rights over the assets held in the Testamentary Trust.

How does a Testamentary Trust protect Assets?

The Trustee of a testamentary Trust legally owns the assets the Testator places in the trust. The beneficiaries who the Testator nominates do not legally own the assets. Therefore, the assets placed in the Trust may be protected from the beneficiaries’ creditors’ in the event a beneficiary declares bankruptcy.

Furthermore, holding assets in a testamentary trust may provide protection in a potential divorce property settlement, although the existence of a testamentary Trust may create an offset with other property in the settlement.

Finally, the beneficiaries listed in the Will, will not have access to the testator’s assets in the Trust to liquidate and spend as they see fit, as the assets are controlled by the Trustee. This can help protect assets from beneficiaries who might misuse their inheritance because they are poor money managers.

How can a Testamentary Trust be tax effective?

As well as asset protection, there are significant tax benefits that can be realised in a well-planned Testamentary Trust structure. Testamentary trusts are ‘discretionary’, which means that the trustee decides how the trust assets are invested and distributed.

The trustee can decide which of the beneficiaries receives the income from the trust. This means that the trustee can make distributions from the trust in a tax effective manner, for example by distributing income to beneficiaries having the most attractive marginal tax rates.

Disadvantages of Testamentary Trusts

Testators should be mindful about the taxation rules for superannuation death benefits if the trust beneficiaries are not confined to dependants.

Testators also need to be aware of any taxation implications for the exemption from capital gains tax on the family home if the residence is held in a trust and for tax concessions for active assets of small businesses in the trust.

One disadvantage is the cost of administering a testamentary trust. If a professional is appointed as trustee, there will be fees for this service. There will be ongoing administrative costs involved in maintaining a trust, such as accountancy fees for preparation of trust taxation returns. The testator needs to consider whether the income generated by their estate will be sufficient to warrant a testamentary trust.

Chiara Nicolaci – Solicitor– Matthies Lawyers

Should you have any queries in regard to estate planning matters, please contact Matthies Lawyers for an obligation-free consultation or call +61 3 8692 2517 today.

Disclaimer: This article contains general information only and is not intended to be a substitute for obtaining legal advice.